33+ mortgage interest tax deductible

Every tax problem has a solution. RD Credits for Gaming Manufacturing Agriculture Architecture Engineering Software.

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

So for simplicity sake if I buy a 1mil housefederal.

. Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on. File Online or In-Person Today. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Web For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for single people or married people filing separately. Discover How HR Block Makes It Easier to File Your Way. The interest on an additional.

Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. This is where communication is vital. Fast convenient with a Tax Pro.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web The mortgage interest tax deduction is a deduction you can claim on the interest charged on your home loan if the property you bought with the loan is. RD Credits for Gaming Manufacturing Agriculture Architecture Engineering Software.

100 Bonus Depreciation Ends December 31 2022. 13 1987 your mortgage interest is fully tax deductible without limits. Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth.

Web You cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16. Web For tax years before 2018 the interest paid on up to 1 million of acquisition indebtedness is deductible if you itemize deductions. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage.

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. In the year you. Web 16 hours agoA 15-year fixed-rate mortgage with todays interest rate of 621 will cost 855 per month in principal and interest on a 100000 mortgage not including taxes.

Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. Ad 50 off Tax Prep when you try Jackson Hewitt. Ad Learn How Simple Filing Taxes Can Be.

Web Things like donations student loan interest and child-care expenses are common tax deductions but what about mortgage interest. Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on. Lets have a look to see.

Web If you took out your mortgage on or before Oct. Web Deducting points means you can deduct 130th of the points each year if its a 30-year mortgagethats 33 a year for each 1000 of points you paid. Web The problem is the bank still issues a mortgage interest statement making it look like a tax deductible item.

Web Answer a few questions to get started. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Basic income information including amounts of your income.

Web Mortgage Interest Tax Deduction You can deduct the mortgage interest you pay on the first 750000 375000 if married filing separately of mortgage debt. Web Unmarried couple with joint mortgage interest deduction - how can we split. 16 2017 then its tax-deductible on.

Web Most homeowners can deduct all of their mortgage interest. Get a free consultation today move towards resolution. Web Is mortgage interest tax deductible.

Web Quick Question on mortgage interest tax deduction California This can be deducted from both state and federal taxes right. Bsch4477 from the link you provided on the IRS website it literally says Both of. Also if your mortgage balance is.

However higher limitations 1 million 500000 if married. Calculating Lower Property Taxes. Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth.

Start Today to File Your Return with HR Block. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Ad Tax levy attorney CPA helping resolve back tax issues no matter how complex.

Homeowners who bought houses before.

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

The Home Mortgage Interest Deduction Lendingtree

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Maximum Mortgage Tax Deduction Benefit Depends On Income

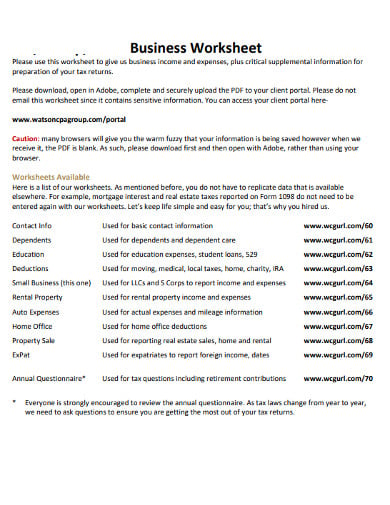

12 Business Expenses Worksheet In Pdf Doc

Tax Shield How Does Tax Shield Save On Taxes Uses Of Tax Shield

Tax Shield Formula How To Calculate Tax Shield With Example

Free 33 Budget Templates In Ms Word Excel Pdf

Maximum Mortgage Tax Deduction Benefit Depends On Income

Mortgage Interest Deduction How It Calculate Tax Savings

Race And Housing Series Mortgage Interest Deduction

Is Mortgage Interest Tax Deductible The Basics 2022 2023

Tax Shield Formula How To Calculate Tax Shield With Example

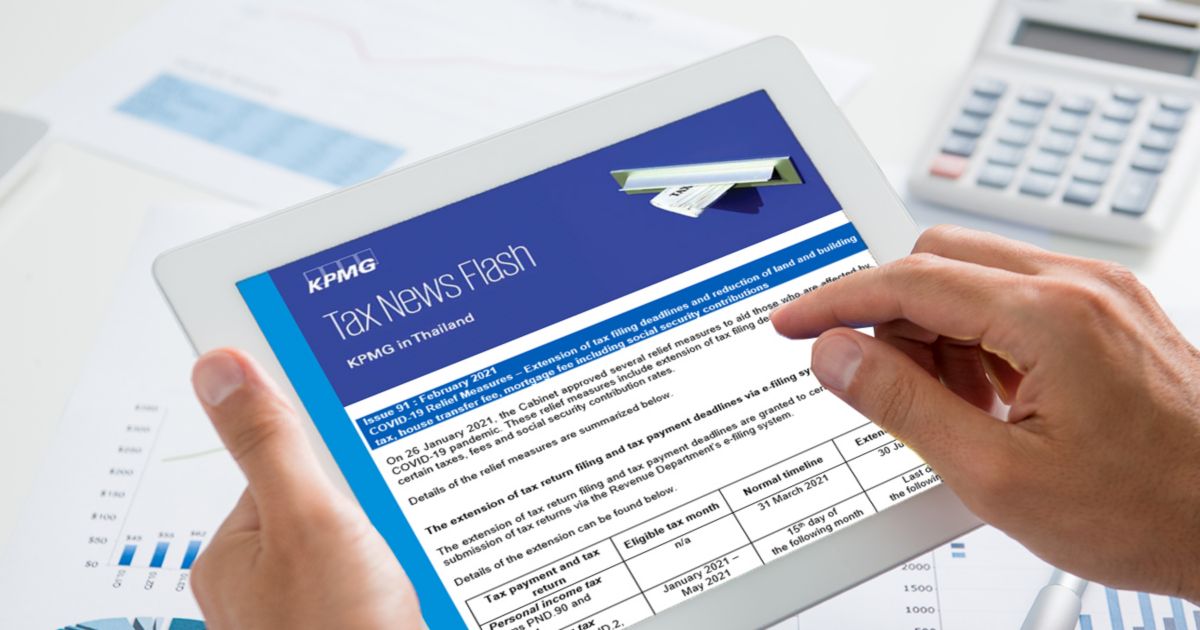

Tax News Flash Issue 101 Kpmg Thailand

Annual Report 2003 2004

Listen To The Smart Real Estate Coach Podcast Real Estate Investing Podcast Deezer

Open Esds